Gold prices are different from city to city, the price in Kolkata is different from Mumbai.Indeed, there are few reasons with respect to why there is a value change. In a perfect world, the rate of gold is dictated by the global gold rates on that day. At that point intelligently, the gold rates ought to be the equivalent all over the place yet that doesn’t actually occur as there are sure factors added to that condition.

Gold is an essential piece of the Indian culture. It is nearly utilized in each feature of one’s life. In any case, there is a little issue or it tends to be alluded to as the comprehensive view and precisely what is that? Gold costs are diverse in each city. All things considered, there are few reasons concerning why there is a value change.

In a perfect world, the rate of gold is controlled by the worldwide gold rates on that day. At that point intelligently, the gold rates ought to be the equivalent all over however that doesn’t actually occur as there are sure factors added to that condition.

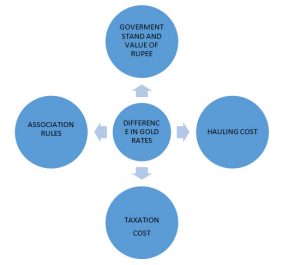

Reasons for different rates:

Pulling costs: Like each item accessible in the market, may it be shopper durables, fundamental things or costly metals like gold, silver and so forth the transportation cost is added to the deal cost and as gold is an overpriced thing the expense of protecting it likewise is added to the expense and is at last charged on account of the client.

Higher the amount, the lesser the cost of gold: Technically it has been a routine with regards to sellers to offer certain limits on account of mass buys done. Same is the situation of gold as well if a specific merchant is buying a mass measure of gold, he may bring about a limited value that is lesser than what is being offered to alternate purchasers, with the goal that will prompt a decrease of costs in the retail section.

Involvement of gold bullion associations: Like there is a relationship for each section in our nation, the gem dealers have their own associations which controls the value structure of the gold for the specific day regularly. These costs are settled two times per day. It is commonly founded on the End of Day (EOD) cost in the earlier day and the worldwide gold market remaining at that specific time as and when determined with other brought about expense on making the gold into an attractive thing which thusly prompts the variety of costs in various urban communities.

Government import duty: Our legislature likewise assumes a critical job in this portion and one may ponder what precisely the administration’s job in the bullion exchange is. All things considered, the administration fixes assess rates as well as the rates of import obligation and as India basically does not mine gold but rather imports it from different nations the rate of import obligation likewise assumes a critical job in the settling of cost for the retail portion. The import obligation depends on the shortage or the overflow of money pooling, in the event that there is a shortfall, there will be an ascent in the import obligation and the other way around.

The value of rupee on Global Market: The situation of rupee against a worldwide money like the dollar on that specific period likewise assumes an imperative job in the evaluating of the gold. In the event that the estimation of rupee falls in the worldwide markets, there will be a critical ascent in the cost of gold and when the estimation of rupee goes up the gold rate will diminish. In any case, in the ongoing years, the cost of gold has been fluctuating, it is possible that it is too high or there is an enduring decline in the cost, so the status of the gold market is in parity.

To aggregate it up, one can without much of a stretch say that gold has lost its gloss and has turned into a non– performing resource in the ongoing years. However, the market for gold in India has not lost its Midas contact.